Top Guidelines Of Erc Vancouver

Table of ContentsNot known Details About Employee Retention Credit Vancouver Some Known Details About Employee Retention Credit Vancouver Erc Vancouver for DummiesUnknown Facts About Erc Portland

Per the CARES Act, whether a business is a tiny or huge employer depends upon whether "the ordinary variety of full-time workers (within the definition of area 4980H of the Internal Earnings Code of 1986)" used throughout 2019 surpassed the suitable threshold amount. The applicable threshold total up to be used depends upon the calendar year.

It ought to be extremely clear at this factor that, inevitably, the variety of staff members is figured out by the While that appears like a rather uncomplicated matter, it didn't begin off this way. Instead, in the CARES Act, Congress decided that "full-time staff members" for ERC purposes would be used as it is specified by the Affordable Treatment Act (ACA).

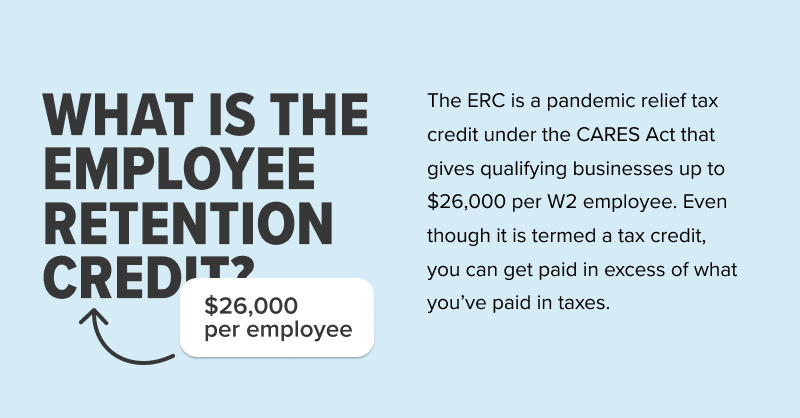

The Employee Retention Credit History (ERC), which was created to motivate companies to keep their labor forces intact during the COVID-19 pandemic, has actually been with us for over 2 years. Sadly questions regarding it continue to remain for several employers. With the new American Rescue Strategy Act (ARPA) prolonging the credit score and increasing eligibility and also the credit history well worth as high as $21,000 per worker for 2021 employers need to reconsider to see if they are qualified for the program.

6 Easy Facts About Erc Vancouver Described

Did the business record a 20% or greater decrease in revenue throughout the initial 3 quarters of 2021, or the fourth quarter of 2020, compared to that same quarter in 2019? If so, did this sector of procedures account for at least 10% of total staff member service hrs, in the exact same quarter(s) of 2019? If you addressed yes to any of the questions above, your service might qualify to obtain a refundable tax credit rating based on the earnings paid to employees.

The ERC may be supplied to any type of firm, regardless of the dimension or staff member matter, and can also be made use of in the past. When procedures went to least partially put on hold owing to a government order see here now relevant to the COVID-19 pandemic, the ERC related to qualified business that paid certifying wages to staff members - erc portland.

State as well as regional federal governments, as well as companies sites that sign out Small Company Loans, are truly the single alternatives. Schedule quarter: Either Firm's procedures were completely or partially disrupted by government decree due to COVID-19 throughout the calendar quarter, or the Employer's complete earnings were less than 50% of the comparable quarter in 2019.

The 2-Minute Rule for Erc Vancouver

There are over a hundred (erc vancouver). If the company has more than 100 employees typically in 2019, after that credit report. Just salaries paid to workers that did not function during the calendar quarter were allowed. In both situations, incomes consist of not only the compensation however likewise a share of something like the price of career health and wellness treatment.

Each state has its own time frame for resuming dining, yet you certify if you couldn't run at full ability owing to a percent constraint or due to the fact that you required to room tables to fulfill social distancing guidelines.

Erc Vancouver for Dummies

The ERC is not limited to small companies; rather, it is open to any type of qualifying companies that run a commercial organization that fits either criteria: Due to COVID-19 OR instructions from an authorized federal government body restricting commerce, travel, or group conferences, the operation of the profession or business is completely or partially halted for the schedule quarter.

You either have less than 501 W2 staff members in the qualifying quarter, or you are a Significantly Troubled click over here Employee. Either: A partial or full government closure impacted your company, AND/OR: You demonstrate a loss of 20% or even more on the Gross Receipts Examination for the qualifying quarter. Also if you have even more than 500 employees, you may qualify as a Badly Distressed Company if you suffer a loss of 90% or more.

Only change the numbers in the light grey boxes; do not change the values in the white blood cells since they include solutions, and transforming the formulas will certainly generate mistakes in your calculations. The text in the light grey cells is just an instance; do not hesitate to eliminate it as well as change it with values that pertain to your company.